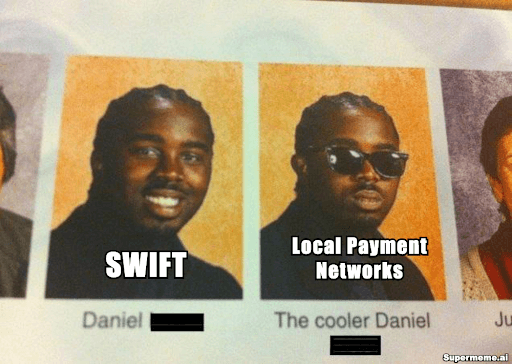

Let's get real for a hot second: if you're still relying exclusively on SWIFT for your international payments, you might as well be sending your money via carrier pigeon wearing designer shoes. Sure, SWIFT has been the granddaddy of global transactions since the 1970s, but much like disco and polyester suits, some things from that era deserve a serious upgrade.

SWIFT (Society for Worldwide Interbank Financial Telecommunication) has been the go-to network for international payments for decades. It's like the financial world's exclusive country club — prestigious, widely recognized, and inexplicably expensive.

Here's the not-so-swift reality:

Local payment networks are like that hole-in-the-wall restaurant that serves better food than the fancy place downtown — less flash, more substance, and your wallet stays pleasantly plump.

When you tap into local payment networks through Routefusion, you're looking at:

Let's break it down with a real-world scenario. Imagine you're sending $10,000 USD to suppliers in Brazil, Mexico, and Singapore every month:

That's $4,500 saved annually. What could your business do with an extra $4,500? (Besides buying 1,500 tacos, which is also a valid business expense in our book.)

Cost savings are just the appetizer in this financial feast:

Local payment networks often settle in hours, not days. Some even clear in real-time. When your Brazilian supplier needs payment for that urgent order, "it's still processing" isn't going to cut it unless you enjoy awkward video call apologies.

Each local network already meets regional compliance requirements. With Routefusion's platform, you get:

Routefusion connects you to multiple local payment networks through a single API. It's like having one remote that controls all your streaming services instead of juggling six different ones and still accidentally opening the garage door.

We're not just throwing you into the local payments jungle with nothing but a compass and good wishes. Routefusion gives you:

SWIFT is like using a sledgehammer to hang a picture — it'll get the job done, but at what cost and with how much collateral damage to your wallet and drywall?

Local payment networks through Routefusion give you the precision, speed, and cost savings that global businesses need in today's economy. Your finance team will thank you, your suppliers will receive payments faster, and your bottom line will get a pleasant boost that might just make your quarterly review slightly less terrifying.

Ready to give SWIFT the pink slip and start saving serious cash on your international payments? Let's talk. Your wallet will write us a thank you note.

Routefusion: Global payments without the global headaches.

- Fee Fiesta: SWIFT transactions typically come with correspondent bank fees, lifting fees, and receiving fees that can range from $20-50 per transaction. And that's before currency conversion costs even enter the chat.

- Hidden Markup Madness: Many banks slap on a 3-5% markup on the exchange rate. That's like paying for economy but getting charged for first class without the legroom or the complimentary champagne.

- Slow-Motion Money: SWIFT transfers often take 3-5 business days. In 2025, when you can get same-day delivery for almost anything else, your money shouldn't be taking a leisurely world tour while your suppliers send passive-aggressive "payment status?" emails.

- Slashed Transaction Fees: Often 40-60% lower than SWIFT equivalents. That's money back in your business, not funding someone else's yacht collection.

- Real Exchange Rates: Get closer to mid-market rates without the inflated markups. Transparency that doesn't require a magnifying glass, a finance degree, and three espressos to understand.

- Batch Processing Efficiency: Send multiple payments through local networks at once, reducing per-transaction costs. It's like carpooling for your money, but without awkward small talk.

- Transaction fees: ~$40 per transfer × 3 countries = $120

- Exchange rate markup: ~4% = $400

- Total monthly cost: $520

- Annual cost: $6,240

- Transaction fees: ~$15 per transfer × 3 countries = $45

- Exchange rate markup: ~1% = $100

- Total monthly cost: $145

- Annual cost: $1,740

- Pre-vetted Networks: We've done the compliance homework so you don't have to cram for the test.

- Automated Screening: Our systems check transactions against global watchlists faster than your compliance officer can say "know your customer."

- Documentation Automation: Less paperwork, more actual work. Revolutionary, we know.

- One Integration, Global Reach: Access 15+ local payment networks through a single API integration. It's like dating one person but getting access to their entire family's Netflix, HBO, and Disney+ accounts.

- Intelligent Routing: Our system automatically selects the most cost-effective payment rail for each transaction. You don't need to know the difference between PIX in Brazil and SPEI in Mexico. That's our problem now.

- Consolidated Reporting: One dashboard to rule them all. See all your transactions across networks in real-time, without jumping between fifteen different banking portals like a deranged tab hoarder.

- Currency Management: Hold balances in multiple currencies without the conversion chaos. Exchange only when rates are favorable, not when you're desperate and willing to accept highway robbery.

- Payroll & Contractor Payments

- AP/AR & Treasury Management

- Global USDC Funding